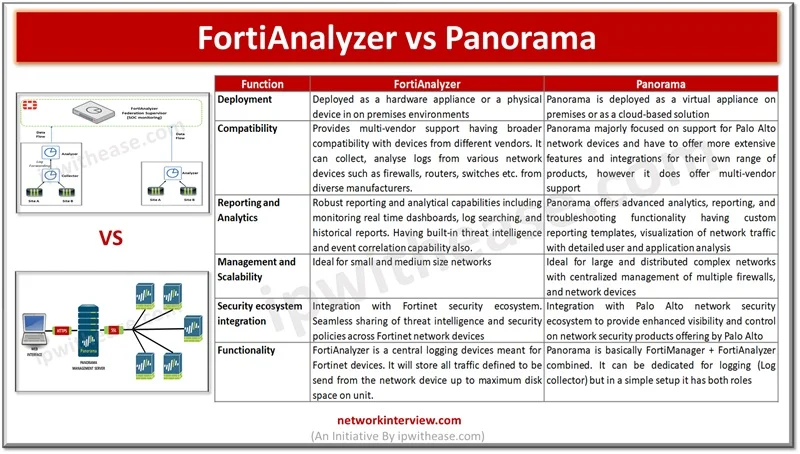

Centralized network management and analysis of network devices is one of the vital requirements of enterprise networks. Individual network component monitoring in larger networks brings a lot of overhead in terms of skills, resources, expertise and not a viable solution …

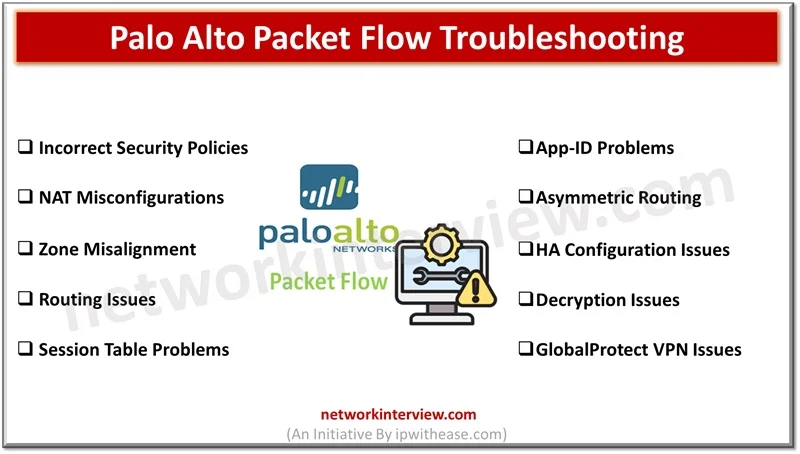

Troubleshooting Palo Alto packet flow issues can be complex. In this blog, we will discuss some common Palo Alto Packet Flow Troubleshooting issues and troubleshooting steps. Palo Alto Packet Flow Troubleshooting Issues 1. Incorrect Security Policies Issue: Traffic is being …

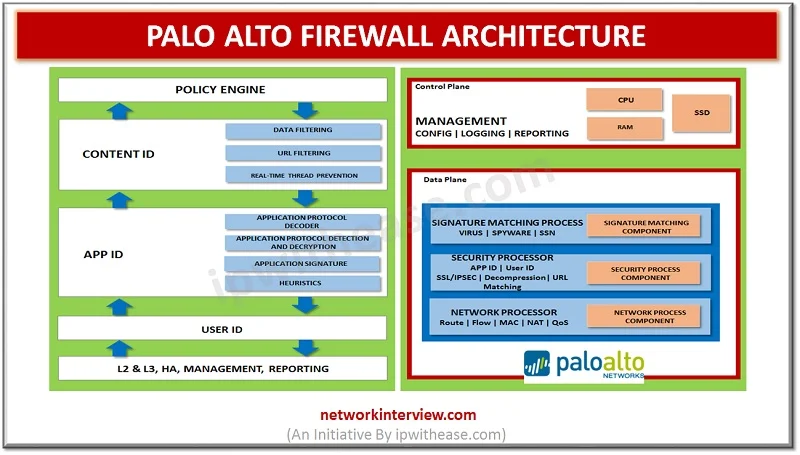

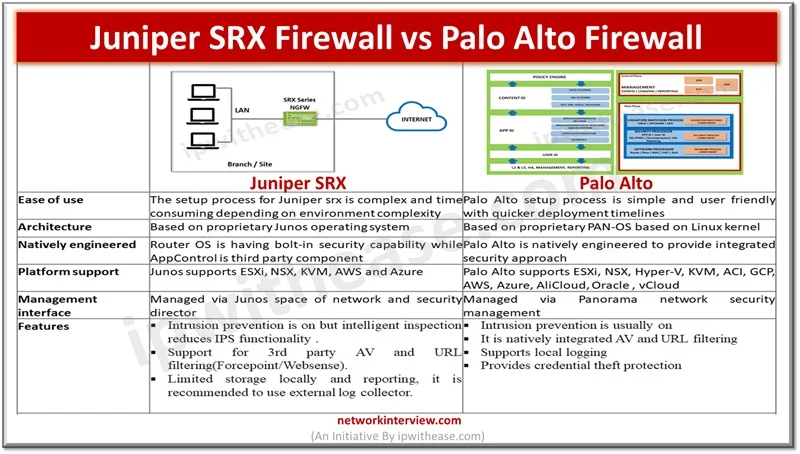

Network architecture refers to the structured approach of network, security devices and services structured to serve the connectivity needs of client devices, also considering controlled traffic flow and availability of services. Network devices typically include switches, routers and firewalls. Palo …

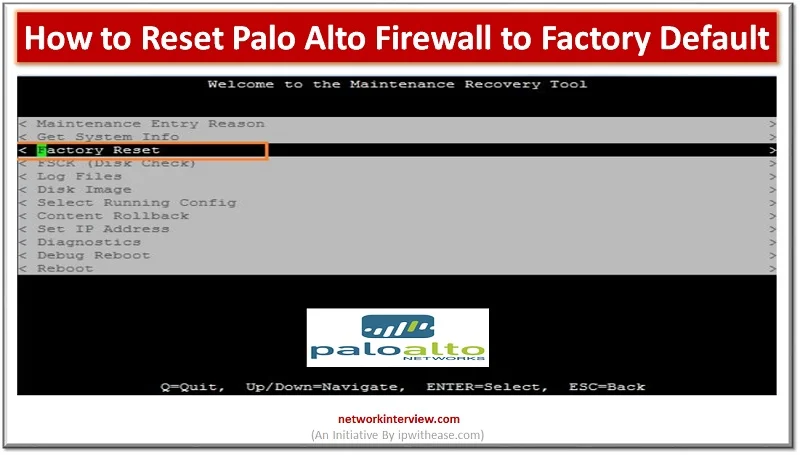

Introduction to Reset Palo Alto Firewall Firewall is a network security device which grants or rejects network access to traffic flowing between untrusted zone (External networks) to trusted (Internal networks) zone. Starting from initial days of Stateful inspection firewalls and …

Firewalls are a key component in perimeter security. Firewalls have come a long way starting from stateful inspection technique to Next Generation firewalls (NGFW) and now a firewall which is machine learning (ML) aware and delivered as cloud native service …

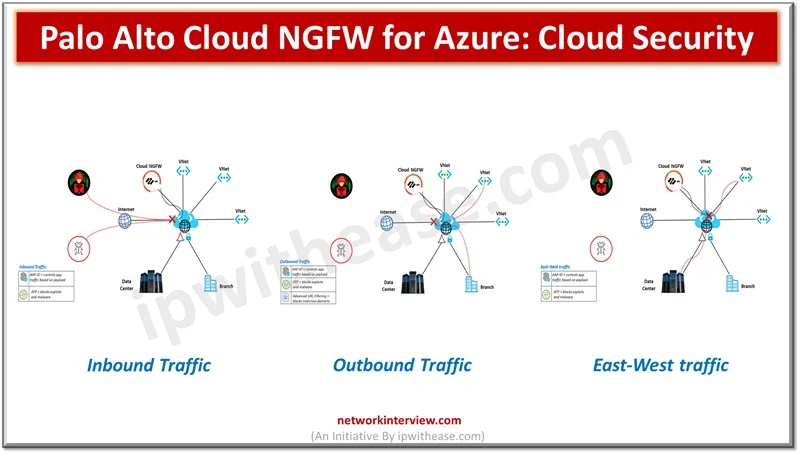

Attackers are constantly looking for vulnerabilities to penetrate your networks. Protection against direct, external threats require extensive network security functions deployed on the edge. Protections on the edge are provided by stateful and next generation firewalls (NGFWs) which offer features …

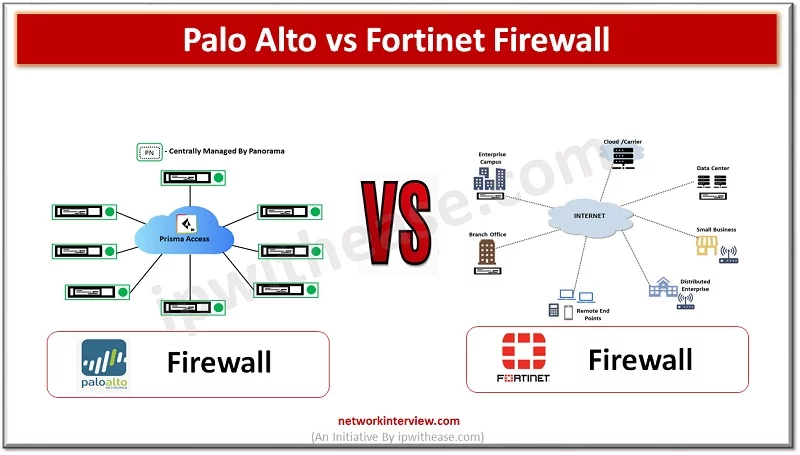

(Diagram depicting Palo Alto vs Fortinet Firewall) Organizations need to keep pace with rapid increase in technology demands such as remote working, anywhere connectivity, lower latency , increased availability along with protection of infrastructure from a never ending list of …

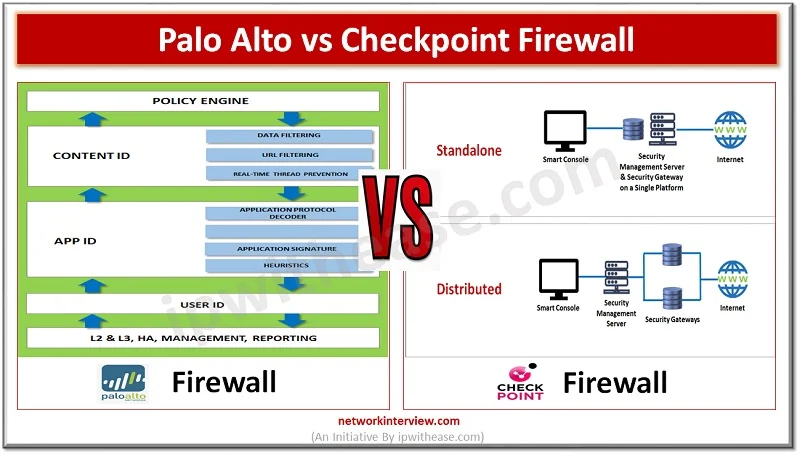

Application aware security is the need of the IT enterprises. Companies are replacing the old and outdated firewalls with Next generation firewalls which are application aware and this evolution can be attributed to web 2.0 where web-based applications and services …

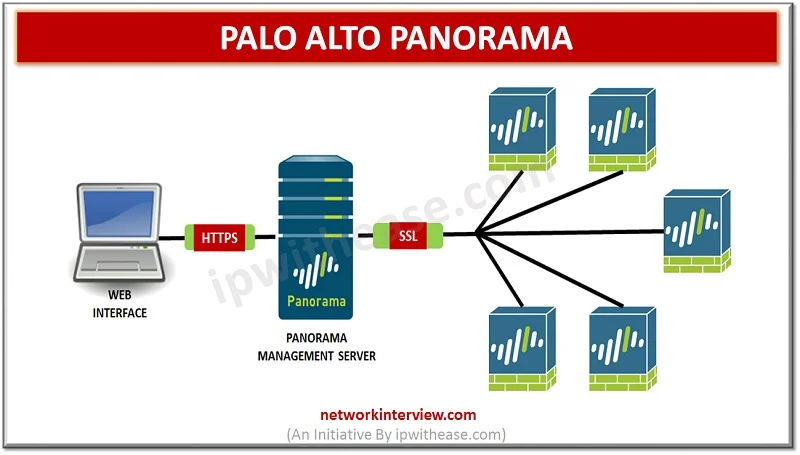

Introduction to Palo Alto Panorama Palo Alto Panorama is the centralized management server that offers a global visibility and control over the multiple Palo Alto Networks next generation firewalls from web interface console. Panorama manage multiple Palo Alto Networks firewalls …

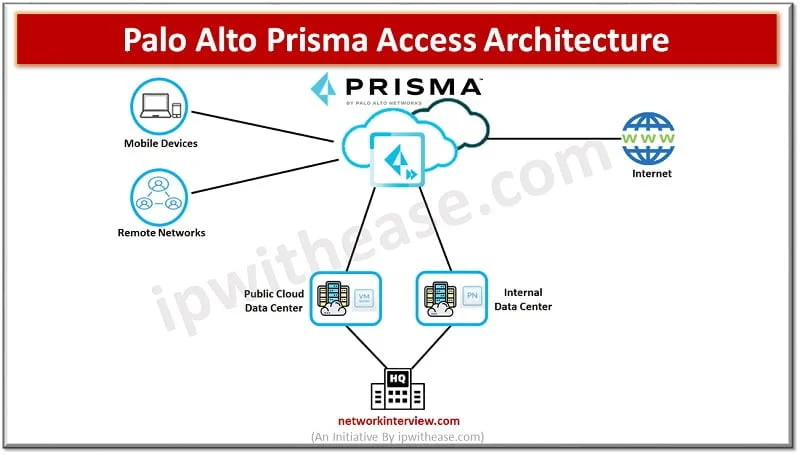

What is Palo Alto Prisma Access? Palo Alto Prisma Access is a Cloud service provided by Palo Alto Networks. This service provides secure access to Internet and business applications that may be hosted on SASE, a corporate headquarters, Data Centres, …

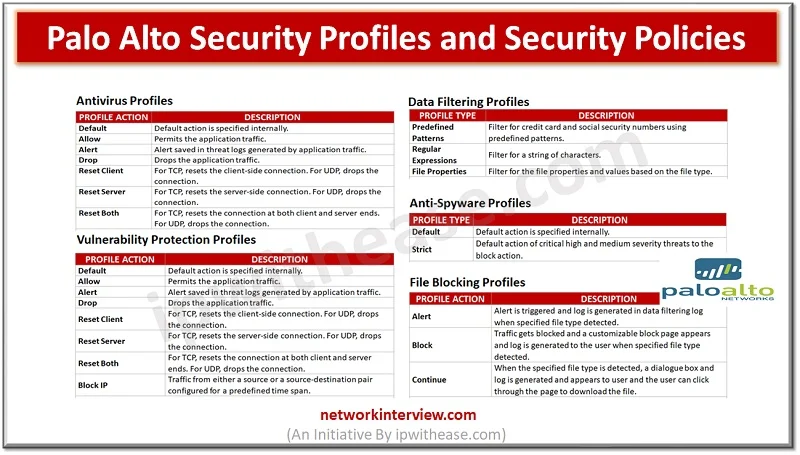

Below are the key profile types provisioned in Palo Alto Firewall. Lets discus all the profile types one by one – Palo Alto Security Profiles & Security Policies While security policy rules enable to allow or block traffic in network, …

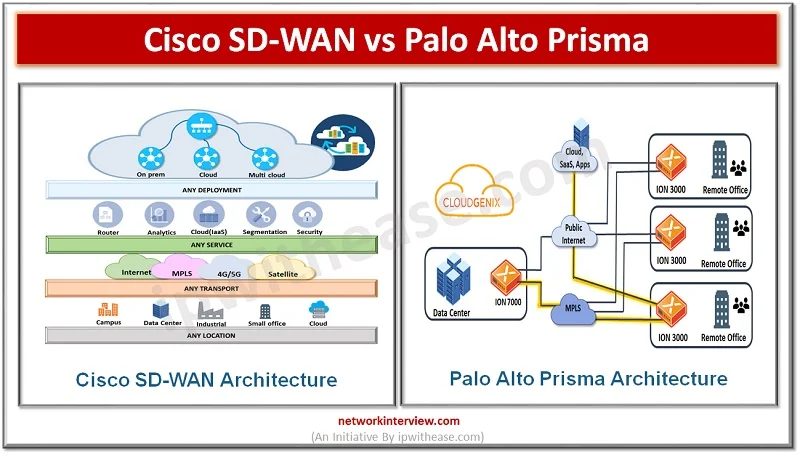

SD-WAN Solutions Penetration of cloud all around the enterprises also brought the need for hybrid networking solutions supporting private WANs and commodity Internet connections to support adoption of cloud applications, remote connectivity, scalability with application performance and including visibility. Major …

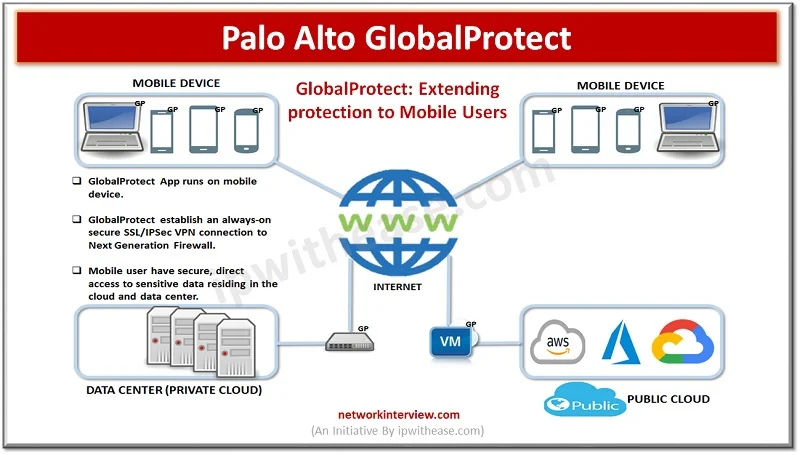

Introduction Palo Alto GlobalProtect is a network security for endpoints that protects mobile workforce by extending the Next-Generation Security Platform to all users geographically anywhere. GlobalProtect secures traffic by applying security policies with Palo Alto next-generation to the application. GlobalProtect …

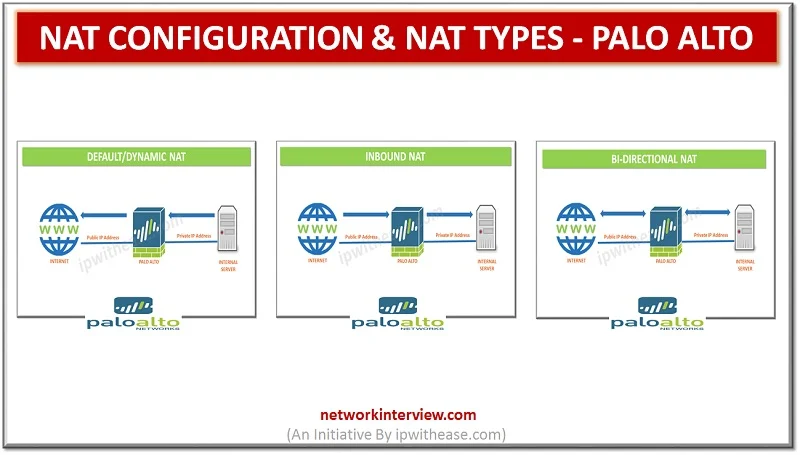

In the previous post we discussed the Architecture of Palo alto firewall. Now, we will discuss the NAT configuration and NAT types in Palo alto. Network Address Translation (NAT) allows to translate private, non-routable IP addresses to one or more …

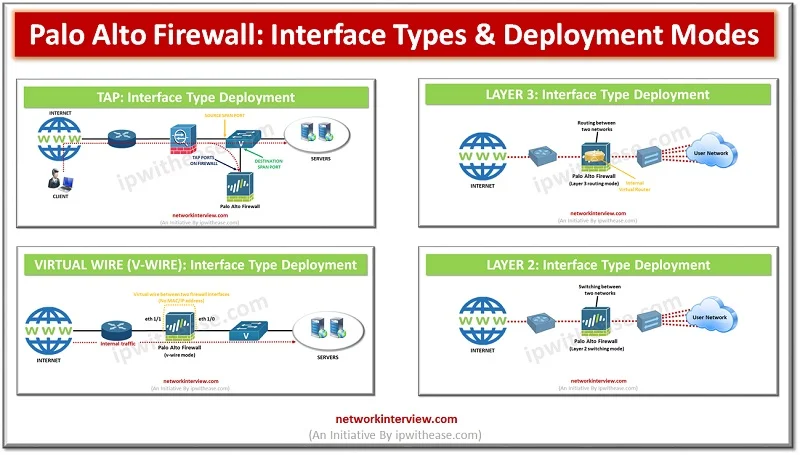

Introduction to Palo Alto Interface types/ Deployment Modes The entry and exit point of traffic in a firewall is enabled by the interface configurations of data ports. Palo Alto being a next-generation firewall, can operate in multiple deployments simultaneously as …

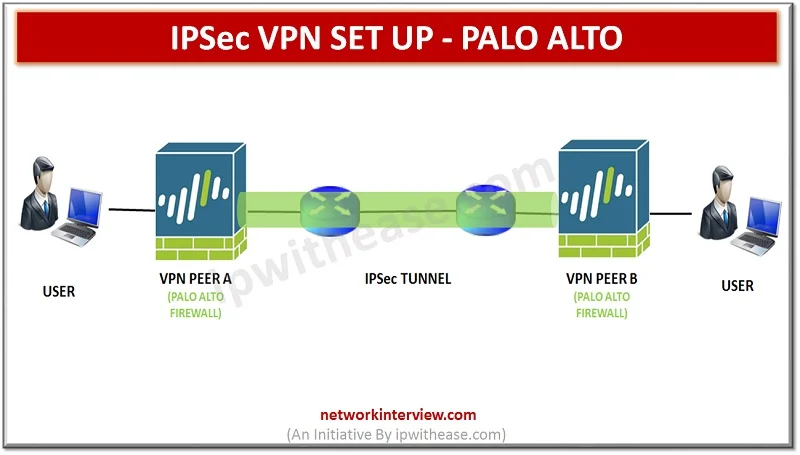

Site-to-Site VPN Overview A VPN connection that allows you to connect two Local Area Networks (LANs) securely is called a site-to-site VPN. Route based VPN can be configuring to connect Palo Alto Networks firewalls located at two sites or to …

Overview In our previous article, we studied IPSec VPN Set Up. In this article we will run through CLI commands and GUI steps to configure an IPSec VPN, including the tunnel and route configuration on a Palo Alto Networks firewall. …

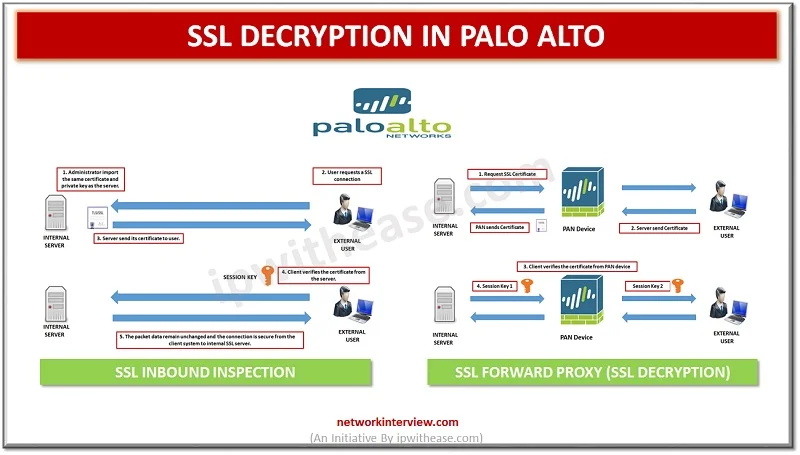

Before digging deep into Palo alto SSL Decryption, let’s first understand what is Decryption? What is Decryption? Palo Alto firewalls can be decrypt and inspect traffic to gain visibility of threats and to control protocols, certificate verification and failure handling. …

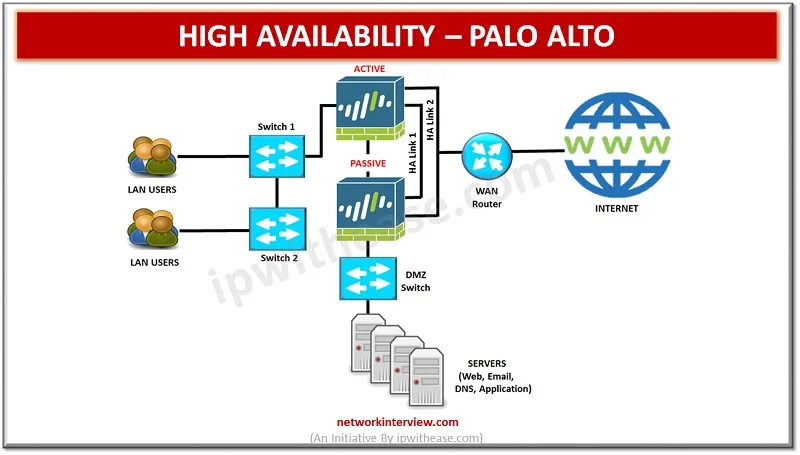

High availability (HA) refers to a system or component that is operational without interruption for long periods of time. High availability (HA) is measured as a percentage, with a 100% percent system indicating a service that experiences zero downtime. High …

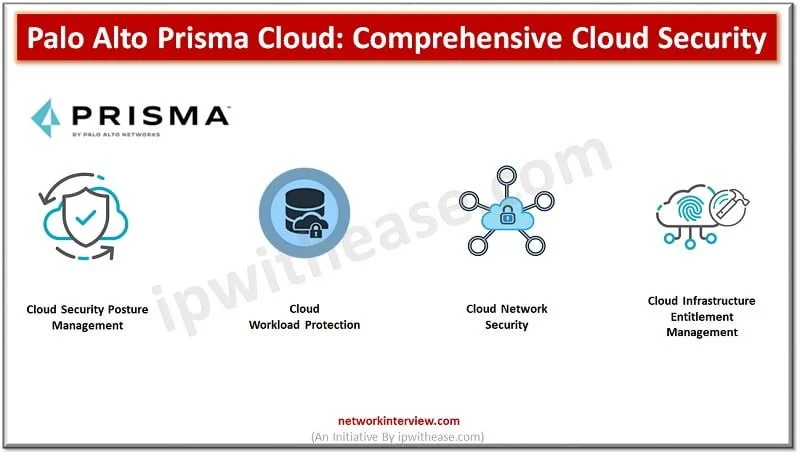

Cloud native technologies are helping Development teams to build and deploy applications faster than before. However, this open architecture increases challenges to Security teams. Cloud workloads are spread-out across Virtual Machine Containers Serverless and many points in between security devices …

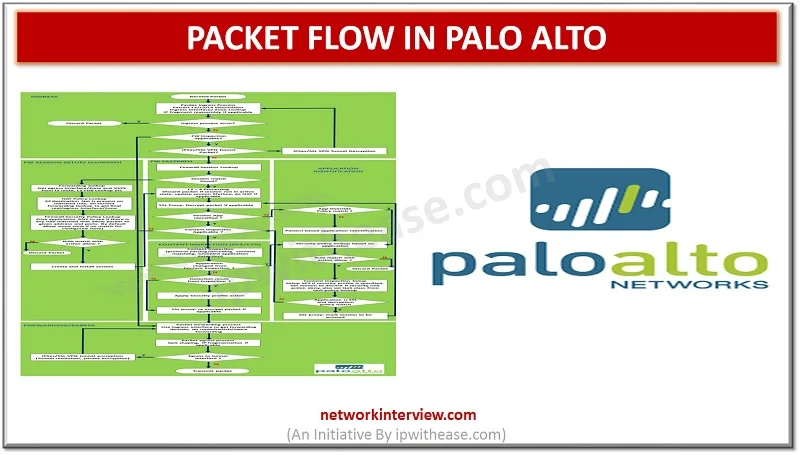

In this article, we will discuss on Packet handling process inside of PAN-OS of Palo Alto firewall. Introduction: Packet Flow in Palo Alto Packet passes through the multiple stages such as ingress and forwarding/egress stages that make packet forwarding decisions on …

Introduction to TCP RST Protection of sensitive data is major challenge from unwanted and unauthorized sources. The next generation firewalls introduced by Palo Alto during year 2010 come up with variety of built in functions and capabilities such as hybrid …

Introduction to Packet Capturing Before discussing Palo alto packet capture, let’s first understand the term packet capture. Packet capture is network interception of data packet which can be analysed , downloaded, archived or discarded. The reason for packet capturing is …

Introduction to Palo Alto Firewall is a network security device that permit or denies network access to traffic flows between an untrusted zone and a trusted zone. Palo Alto Firewall is one of the globally coveted and widely preferred Security …

Introduction Palo Alto has been considered one of the most coveted and preferred Next generation Firewall considering its robust performance, deep level of packet inspection and myriad of features required in enterprise and service provider domain. When troubleshooting network and …

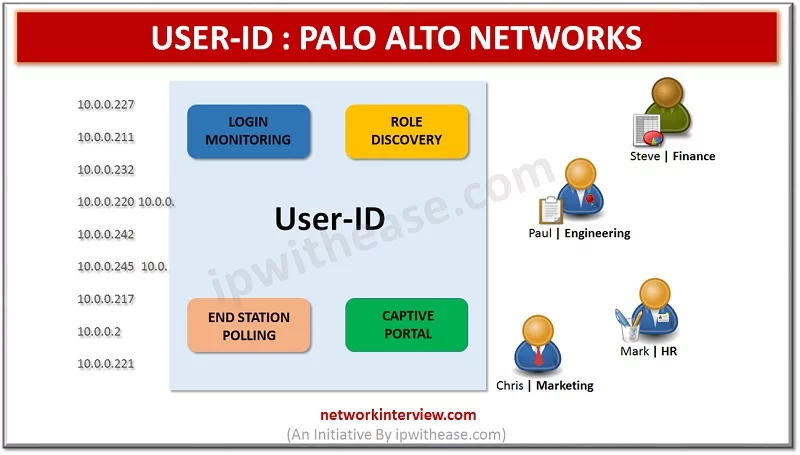

In this article, we will understand the terminologies related to USER ID and their role w.r.t login monitoring, role discovery and related nuances. USER ID : PALO ALTO NETWORKS User Identification is a very unique feature of Palo Alto firewall …